Wholesaler

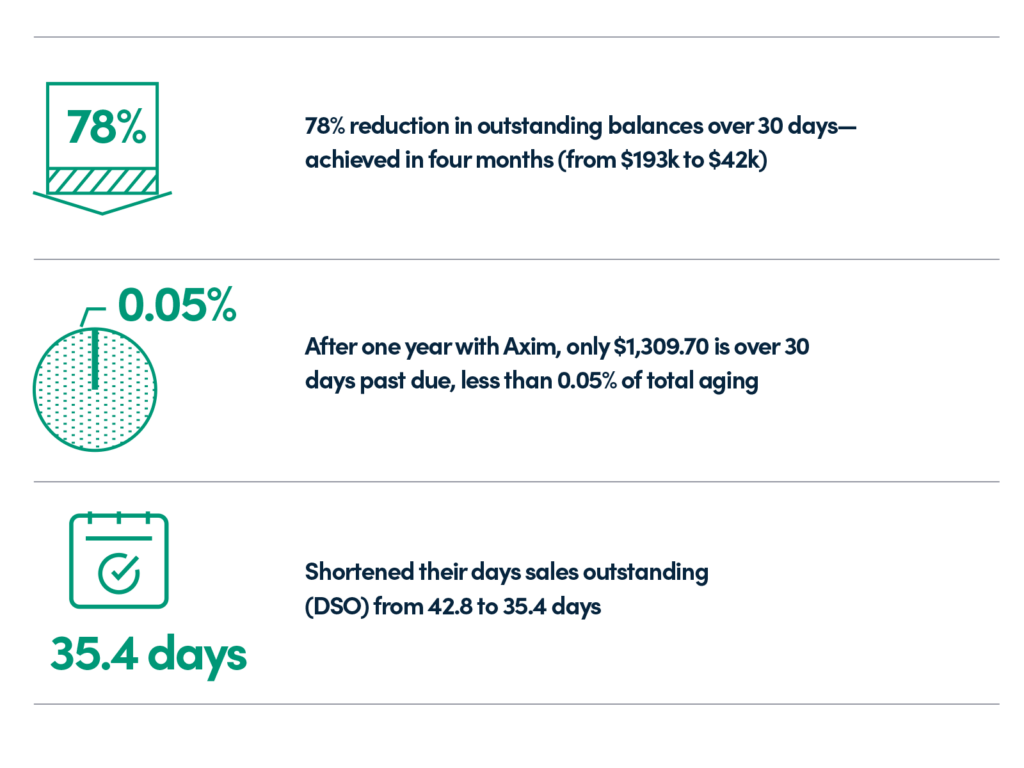

78% overdue balance reduction in 4 months for wholesaler.

Mid-sized wholesaler working with small retailers

400-500 past-due invoices at any given time

Overview

Client Pain Points

A mid-sized wholesaler working with mostly small, family-owned retailers, was facing a massive accounts receivable problem. They consistently had between 400-500 past-due invoices at any given time, and their cash flow problem put their company’s success at risk.

Solutions Implemented

With hundreds of aging invoices and minimal time, it was critical to put a system in place that quickly produced results. Our proprietary software enabled us to strategically target their biggest problems by:

Results

Our proactive customer service approach appealed to both our wholesaler client and their customers. With Axim as their reliable outsourced AR partner, the company has transformed an albatross of hundreds of aging invoices into a stable, responsive, and satisfied customer base that rebuys and pays on time.