08.15.2022 | Posted by Erik

Summer Slump? What to Do When You Have Trouble Reaching Clients & Collecting AR

Business tends to slow down during the summertime. The kids are out of school. People take vacations. Offices close early more often, and people aren’t on the phone or emailing as much. In short, the overall atmosphere in the air is fun and relaxing, and people are much more prone to clocking out a little early.

In business, we call this period the “summer slump.” We’re used to things getting a little more laid back and slower during the summer months. This year, though, with recession fears on the horizon and inflation woes raging, many business leaders are wondering if what they’re experiencing now is more than the usual seasonal slowdown.

In business, we call this period the “summer slump.” We’re used to things getting a little more laid back and slower during the summer months. This year, though, with recession fears on the horizon and inflation woes raging, many business leaders are wondering if what they’re experiencing now is more than the usual seasonal slowdown.

As an outsource receivables company, people come to us when they’re tired of managing their AR or when their customers stop paying. As a result, we spend every day interfacing with businesses that are struggling to keep up with their invoices, and recently we’ve noticed some trends. Let’s dig in.

The Inside Scoop From An Accounts Receivable Management Services Provider

When the economy is bad, people have a harder time keeping up with their bills. As an AR company, when we see sky-high inflation rates, stock market volatility, and supply chain issues, we expect to see a corresponding uptick in business and a decrease in payments.

But as any outsource receivables company can tell you, things tend to get a little sluggish during the summer months, so we’re much slower to raise the alarm during this season. Instead, we rely on our data.

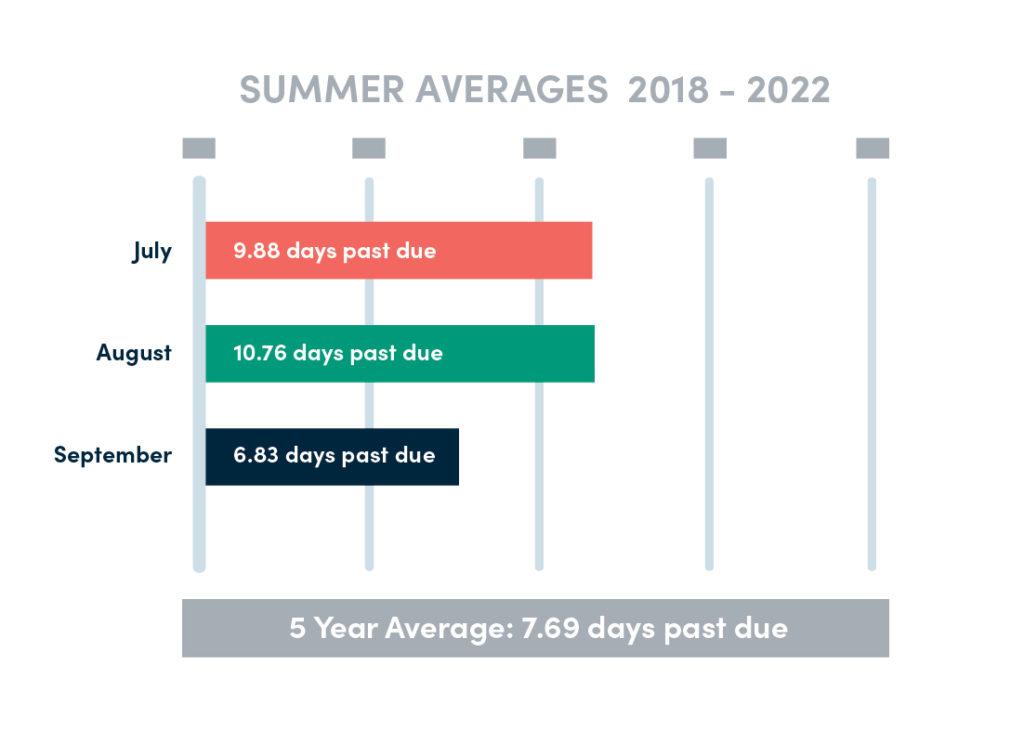

Over the past five years, our clients get paid on average 7.69 days past due, but year after year, July and August are always a bit slower (at 10.32 days past due). But in September, things usually pick up to a better-than-average rate of 6.83 days. If this year stays on trend, then payments should speed up after the summer months.

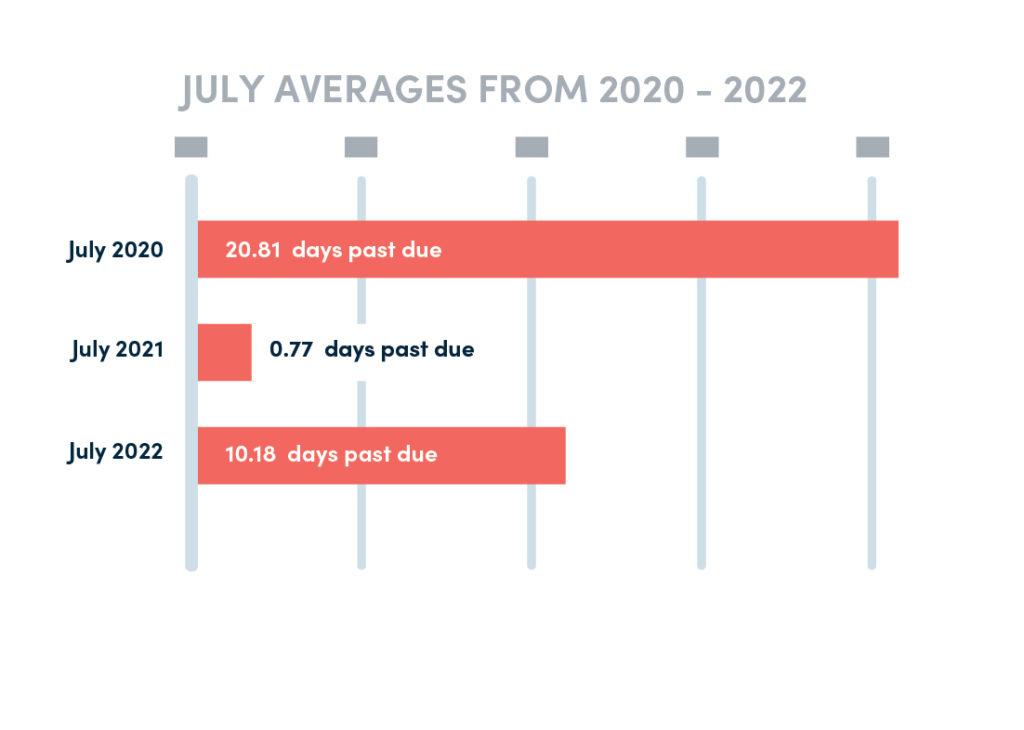

But with the looming recession talk, we wanted to take a more granular look at the data, so we zoomed in on the July payments for 2020, 2021, and 2022 to compare.

During peak COVID (July 2020), our clients were paid an average of 20.81 days past due. A year later, in July 2021, things had improved drastically, with our clients getting paid on average only .77 days late. This year, our clients were paid an average of 10.18 days late. If these numbers are any indication, things aren’t as bad as during COVID times, but they’re definitely worse than last year.

While we haven’t seen very many companies putting their payments on hold (yet), we are starting to see business slow down a little across our customers and companies who weren’t having issues with payments before are beginning to struggle a bit more.

All this tells us that this year’s summer slump might be masking a more significant slowdown. Thankfully, there are some things you can do to prepare.

Read more: Post-Covid Accounts Receivable Management

Mitigating the Summer Slump and Planning for a Recession

While we have some insight as an outsource receivables company, we don’t know for sure what will happen – No one does.

We do know that whether it’s about riding out the rest of the summer or buckling in for a longer haul, there are a few things you should do now – while people are still paying – to prepare for what may come. It all comes down to checking the basics and ensuring all your ducks are in a row.

A significant portion of past dues are a direct result of invoices not getting sent according to the customer’s expectations. So, during slow months and in preparation for slowdowns, it’s a good idea to cross your t’s and dot your I’s. Essentially, reach out and make sure you’re billing all your customers correctly, like sending the invoices to the right person with the right information on them.

It’s also a great time to identify your at-risk customers, tighten up your processes, and reduce your overall exposure.

For a complete AR recession preparation checklist, check out our recent blog here.

Consider Outsource Receivables Management

It’s hard to tell if the summer slowdown you’re experiencing right now is just the typical seasonal slump or if it’s something bigger. In either scenario, however, the best thing to do right now is to get back to the AR basics so you’re prepared for whatever may come.

Alternatively, if you’re looking to offload your outsource receivables management or get it set up for success now, we’d love to help. Here at Axim, we provide accounts receivable management services focused on customer service.